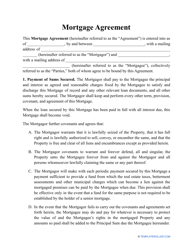

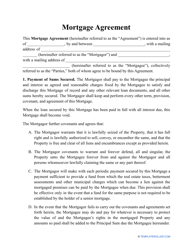

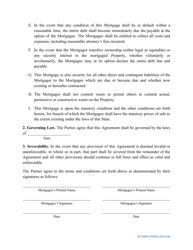

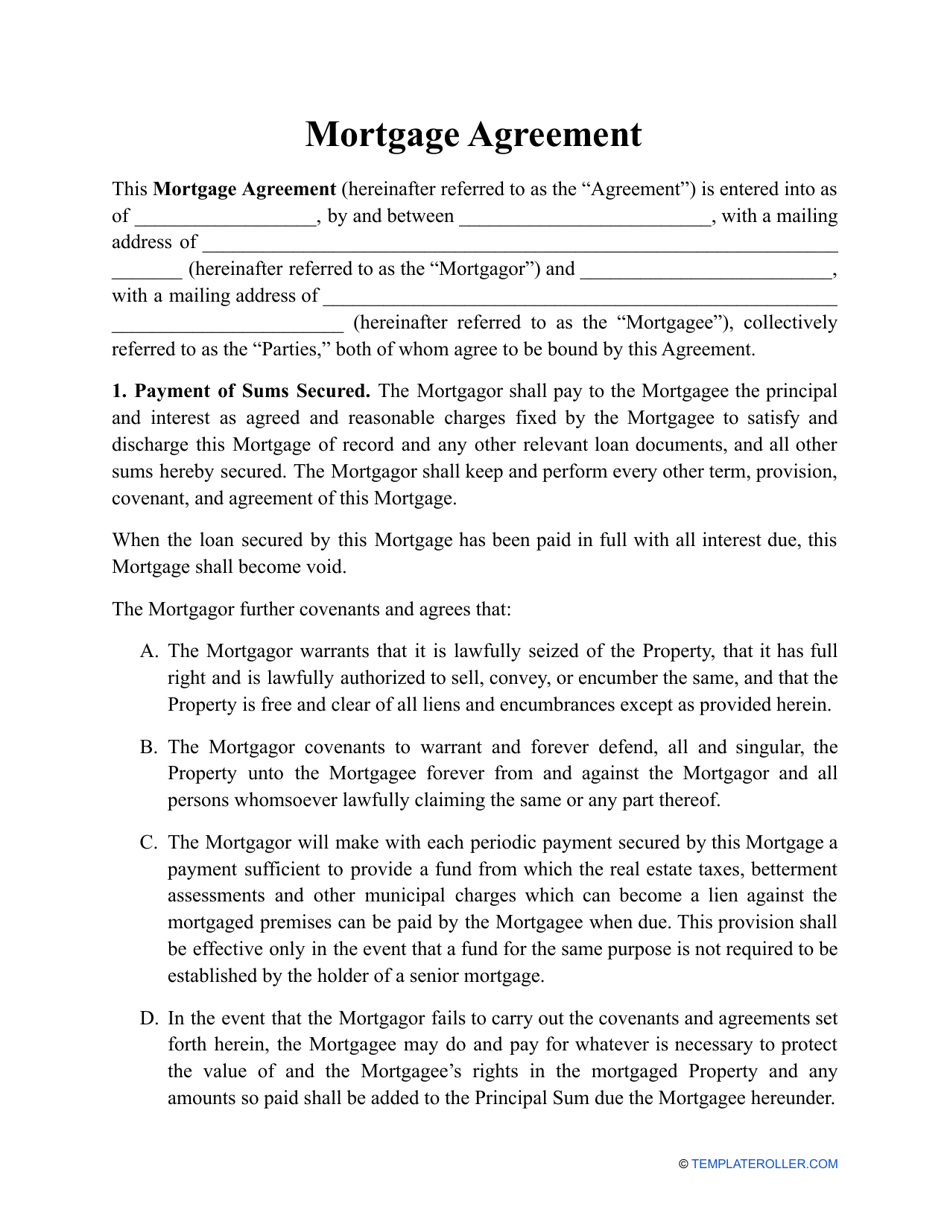

Mortgage Agreement Template

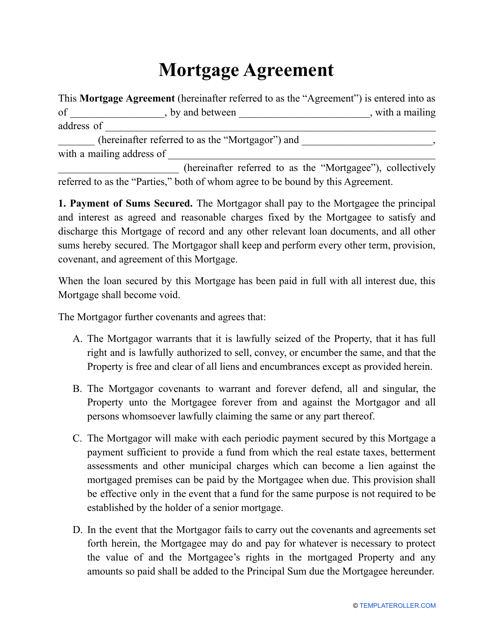

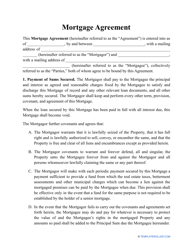

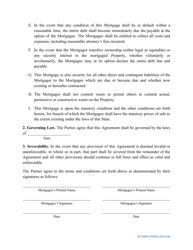

A Mortgage Agreement is a legal contract signed by the lender (mortgagee) and the borrower (mortgagor) to create a lien on the property the mortgagor has in their possession as a means to secure the loan. Usually signed by the financial institution such as a bank or mortgage company and the homeowner, this document indicates the house or apartment described in writing is not considered an asset that acts as a backing for the loan.

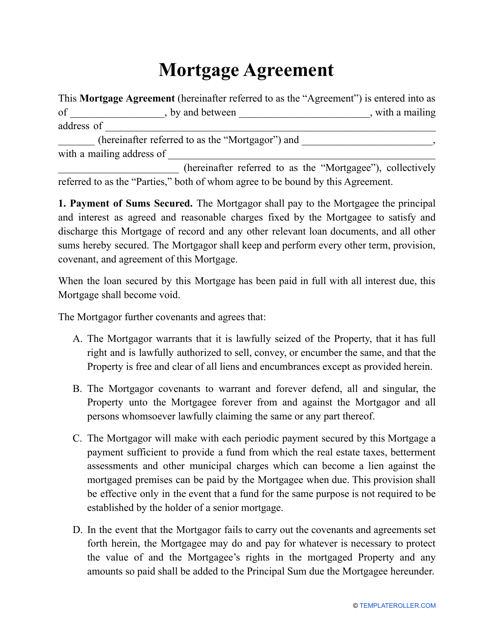

Click on the link below to download a printable Mortgage Agreement template. Do not forget to customize and fill out your pre-made to reflect any additional considerations you have negotiated with the other party.

ADVERTISEMENT

How to Write a Mortgage Agreement?

There is no uniform Mortgage Agreement format but here is how we recommend filling out a Mortgage Agreement Form:

- Indicate the parties to the contract - a mortgagor and a mortgagee. You need to state their names and addresses to simplify identification in case there is a misunderstanding in the future.

- If the borrower's income seems insufficient to the lender, they may require one more party to sign the contract and comply with all its provisions - a cosigner. This individual or entity will guarantee the mortgagee will fulfill their contractual obligations, and if they fail to do so, the cosigner will have joint responsibility for the mortgage repayment.

- Record the legal address of the property that will be burdened with a lien. Indicate all the buildings, improvements, and additions to the real estate in question that will be covered by the mortgage. If necessary, enclose a floor plan, diagrams, and schemes that demonstrate the boundaries of the property to the contract.

- Acknowledge the lien put by the lender on the property as collateral for the loan. The borrower must confirm they agree to transfer the rights to the real estate to the lender if they fail to comply with the mortgage terms - including but not limited to the responsibility to make timely mortgage payments.

- Add the payment information - the amount of money the mortgagee pays every month, the interest rate, and possible prepayment. Enter the maturity date - this is when the final mortgage payment will be due. Even if you prepare a simple Mortgage Agreement that is one page long it must contain the basic payment details and the reference to additional costs that may be associated with the mortgage.

- Sign and date the document. You must do it in front of a notary public who then stamps the Mortgage Agreement Form with a notary seal to verify the authenticity of the signatures.

Once the agreement is signed and notarized, the parties must submit it to the local county clerk's office to register a lien. Both the lender and the borrower keep a copy of the contract for their records - as well as other loan documents that constitute the mortgage paperwork.

Check out these property-related topics:

- Loan Agreement;

- Loan Amortization Schedule;

- Mortgage Lien Release;

- Learn more about home loans, land loans, and refinancing.

Download Mortgage Agreement Template

4.3 of 5 ( 26 votes )

1

2

Prev 1 2 Next

ADVERTISEMENT

Linked Topics

Real Estate Forms for Homebuyers Mortgage Agreement Form Real Estate Agreement Loan Agreement Form Real Estate

Related Documents

- Loan Amortization Schedule Template

- Mortgage Lien Release Form

- Gift Letter for Mortgage Template

- Mortgage Commitment Letter Template

- Sample Mortgage Pre-approval Letter

- Sample Gift Letter for Mortgage

- Sample Mortgage Loan Officer Interview Questions

- Sample Mortgage Loan Billing Statement

- Sample Quarterly Mortgage Statement

- Sample Mortgage Commitment Letter

- Mortgage Pre-approval Letter Template

- Mortgage Loan Agreement Template

- Revolving Credit Agreement Template

- Credit Reference Request Form

- Sample Dispute Letter to Credit Bureau

- Credit Report Template

- Request Form for Reimbursement Due to Partial Discharge of a Federal Consolidation Loan (Loan Holder/Servicer)

- Sample Hardship Letter for Loan Modifications

- Shareholder Loan Agreement Template

- Equipment Loan Template

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.